Homepage > Practice Management

The Medicare Access and CHIP Reauthorization Act (MACRA), signed into law in April 2015, repealed the Sustainable Growth Rate (SGR) and instituted significant reforms to the Medicare physician payment system. MACRA created the Quality Payment Program, which consists of two payment pathways.

The Merit-based Incentive Payment System (MIPS) and Alternative Payment Models (APMs) both require provider payments to be associated with performance metrics or value-based assessments.

MIPS uses an array of metrics to adjust payments, whereas financial risk and performance assessment under APMs depend on the model chosen. MIPS payment adjustments and the APM incentive are based on performance two years prior to the payment year – that is, performance in 2026 will determine payments in 2028.

| Financial Risk Associated with Performance Year 2026 | |

|---|---|

| MIPS | +/- 9% of Medicare Part B Payments in 2028 and lower PFS conversion factor update (0.25%) |

| Advanced APMs | Financial Risk Associated with the APM model. |

MIPS combines performance across four categories to give a score on a 0-100 point scale. The score is then used to calculate a payment adjustment.

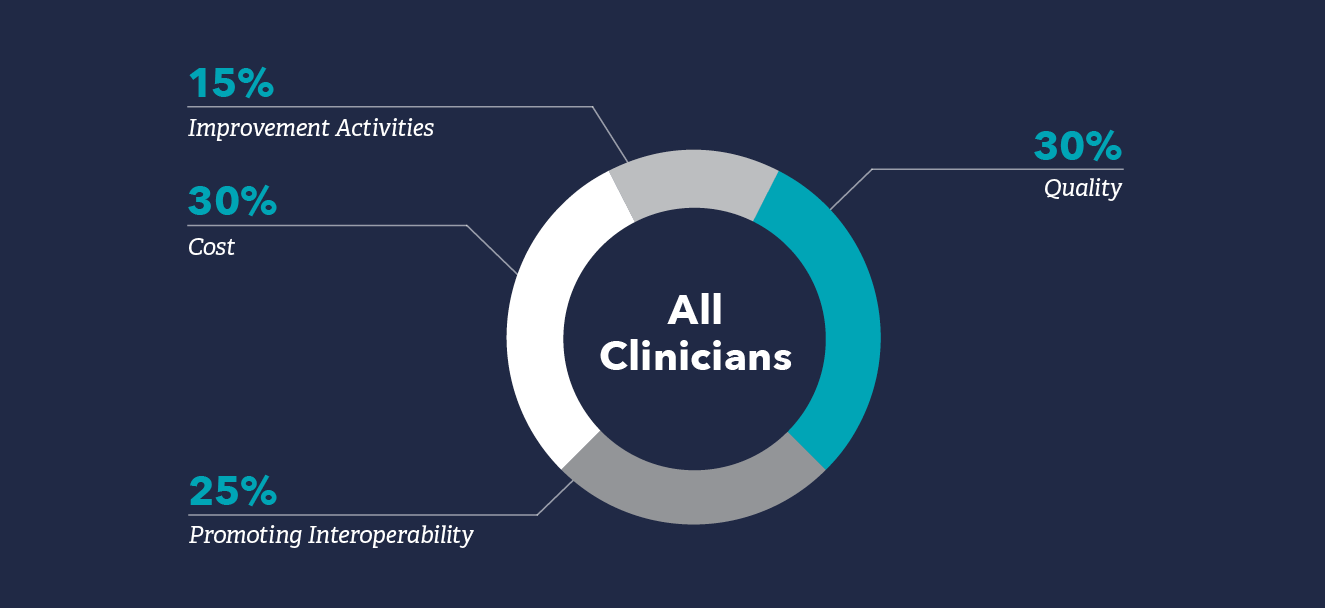

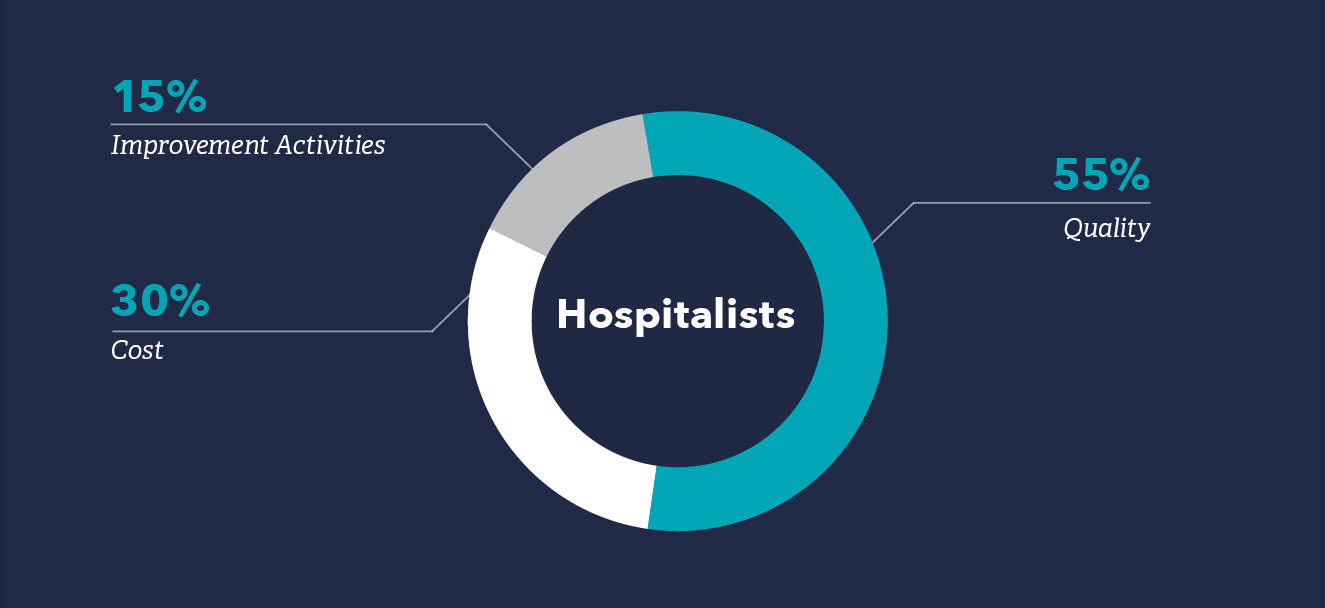

The weighting for each of the four MIPS categories – Quality, Cost, Promoting Interoperability, and Improvement Activities – in 2026 are below. Note that hospitalists’ weighting typically differs from the average MIPS clinician due to an exemption from Promoting Interoperability.

The Quality category replaces the PQRS and requires providers to report on quality measures. Scoring in this category will be based on performance on those measures providers choose to report.

In 2026, providers will be required to report on at least six quality measures, one of which is an outcome measure. For hospitalists, the quality category will be 55% of their MIPS score. Most hospitalists will not have enough quality measures to report and will be subject to a validation process to ensure there are no other measures available to them.

Promoting Interoperability is centered around the use of Certified Electronic Health Record Technology (CEHRT). Hospitalists are typically exempt from Promoting Interoperability if they meet the definition of “hospital-based,” which would shift the category weight to the Quality category. “Hospital-based” is defined as providers who bill 75% or more of Medicare Part B services in Place of Service 19 (off-campus outpatient hospital), 21 (inpatient), 22 (hospital outpatient) and 23 (ER).

Hospitalists who practice significantly (>25% of services) in settings such as skilled nursing facilities (SNFs) will still be subject to this category. SHM recommends these providers apply for hardship exceptions if they are unable to meet the category requirements.

The Improvement Activities category is based upon providers completing a range of activities designed to improve or expand provided care. CMS created an Improvement Activities inventory. Generally, individuals or groups need to attest to two activities during the performance year. Those with small practice, rural, non-patient facing or health professional shortage area special statuses must report on one activity.

The Cost category comprises cost and efficiency measures, such as the Total Per Capita Costs (TPCC) and Medicare Spending Per Beneficiary (MSPB) measures, and Episode-based Cost Measures. Scoring in this category is based on performance in CMS-calculated cost measures. Generally, hospitalists and hospital medicine groups should receive a score on the MSPB and certain episode-based cost measures, but not the TPCC.

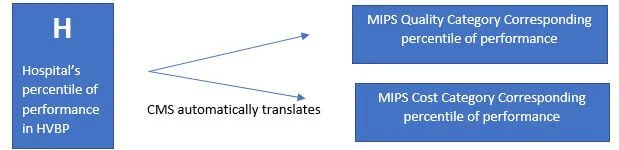

Beginning with Performance Year 2019, CMS has a reporting option for facility-based providers. This option allows providers to receive a score in their Quality and Cost categories based on their hospital’s performance in the Hospital Value-Based Purchasing (HVBP) Program. CMS automatically calculates a score for all providers and groups that qualify. No need to report on quality measures – unless you want to.

Who qualifies? Individual providers who bill more than 75% of their Medicare Part B services in Place of Service 21 (inpatient), 22 (hospital outpatient), and 23 (ER); bill at least 1 service in POS 21 or 23; and work in a hospital that receives a HVBP score. Groups qualify if 75% of their individual providers meet the above definition (are considered facility-based).

The APM pathway is designed to incentivize the adoption of payment models that move away from the Medicare fee-for-service system. To be considered an “Advanced APM” for this pathway, the model must include an element of upside and downside financial risk, involve quality measures, and utilize Certified Electronic Health Record Technology (CEHRT).

Meeting the thresholds for Qualifying Participant (QP) in an approved Advanced APM exempts providers from participating in the MIPS and makes them eligible for a higher conversion factor update to Medicare payments (0.75% vs 0.25%).

Understanding the ins and outs of the policies will help hospitalists choose the best path forward for themselves and for their groups. The MIPS and APMs will be updated and refined through the regulatory rulemaking process each year.

For the most up-to-date information, explore the program and its policies on CMS’ Quality Payment Program website, qpp.cms.gov.

Stay informed with SHM through SHM’s Grassroots Network and check back as policies develop for the most up-to-date information on MACRA. Subscribe to the Grassroots Network now.

Prepare yourself and your group for the MIPS and APMs. 2026 performance will be used to determine payments in 2028.

To determine if you are eligible for the 2026 reporting year, use the MIPS Participation Lookup Tool by inputting your NPI.

Have questions? Contact SHM’s Practice Management staff at pm@hospitalmedicine.org.

By sharing your experiences with other hospitalists and with SHM, you can help your colleagues overcome reporting and performance issues and help SHM advocate for better policies for hospitalists.

This website uses cookies to improve your user experience.